The End of Enterprise Sales as We Know It: How PLG and AI Are Flipping B2B Software Selection

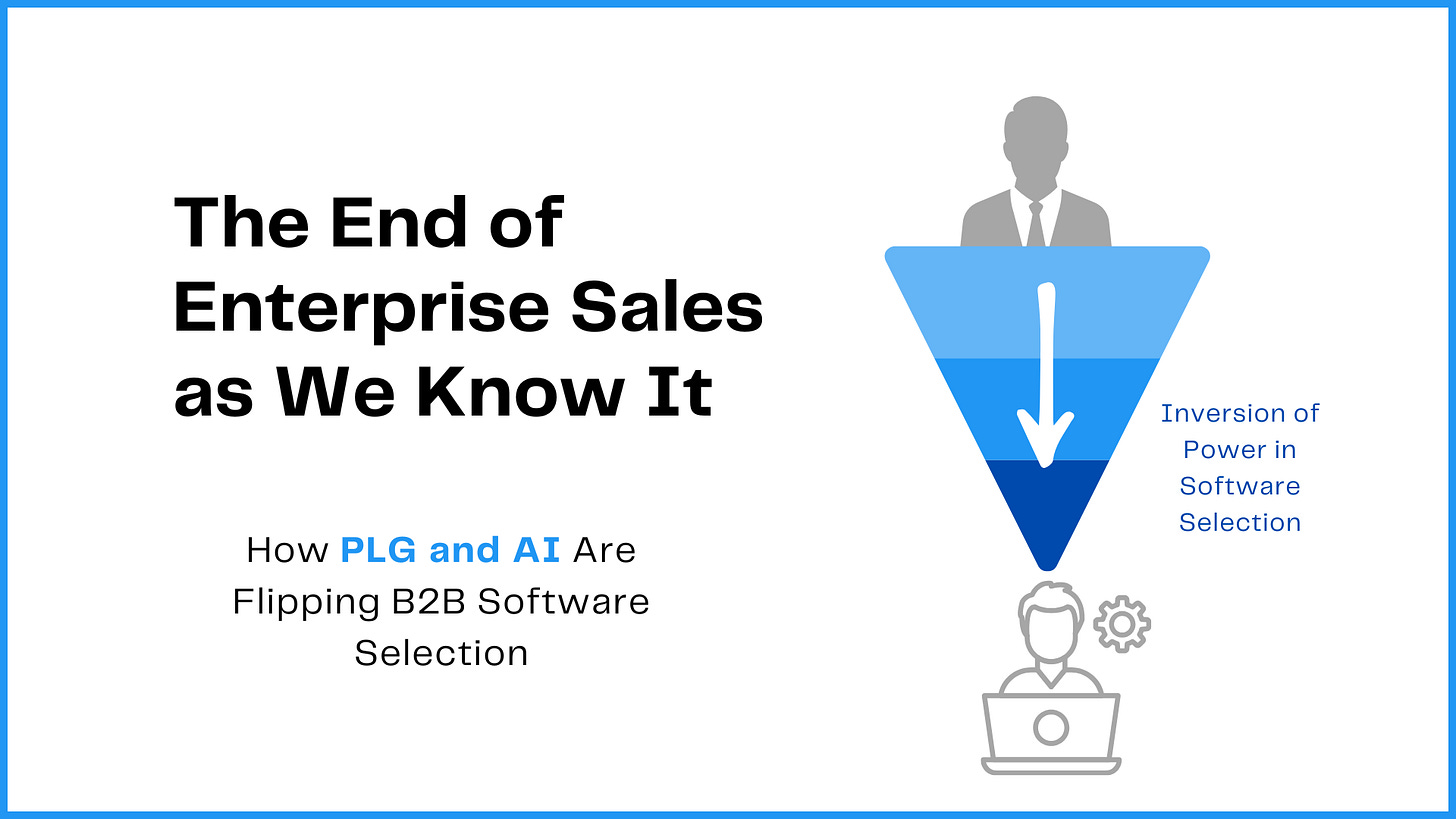

Inversion of Power in Software Selection

The B2B software landscape is experiencing a seismic shift. Traditional enterprise sales models—perfected by giants like SAP, Oracle, and Salesforce—are gradually losing effectiveness as two powerful forces converge: Product-Led Growth (PLG) and artificial intelligence. This transformation isn't just changing how software is sold; it's fundamentally altering how it's selected, implemented, and valued.

As someone who has navigated these waters at Chargebee and observed these trends across the industry, I've witnessed firsthand how the power dynamics in B2B software selection have inverted. In this first post of a four-part series, I'll explore how bottom-up adoption is replacing top-down decision making, and why this matters for everyone in the B2B ecosystem.

The Inversion of Power in Software Selection

For decades, enterprise software selection followed a predictable pattern: executives and IT leaders would evaluate options, create shortlists, conduct lengthy proofs of concept, negotiate massive contracts, and then implement the chosen solution across the organization—often with mixed results when it came to actual user adoption.

Today, that process is increasingly flipped on its head.

Users discover and adopt tools independently. They try free versions, experiment with basic functionality, and only escalate to formal purchasing processes when they've already experienced value. By the time procurement gets involved, the selection has effectively already happened through organic adoption.

This bottom-up motion fundamentally changes who holds power in the purchasing decision. IT and procurement still have a seat at the table, but they're now more validators than gatekeepers.

What's fascinating is how this shift transforms what matters in software evaluation:

Time-to-value trumps comprehensive feature lists

User experience outweighs technical specifications

Incremental adoption paths become more important than enterprise-wide standardization

Integration capabilities matter more than end-to-end suite coverage

AI: The Accelerant to This Transformation

If PLG lit the fuse on this transformation, AI is pouring gasoline on the fire.

As AI capabilities become embedded within B2B solutions, the traditional differentiation through extensive pre-built functionality becomes less important. When AI agents can easily extend basic capabilities through natural language interactions, the value proposition of massive feature-rich suites significantly diminishes.

Consider what this means: A focused, specialized tool with strong AI integration can now effectively compete against established enterprise suites because customers can start small and extend capabilities through AI rather than purchasing comprehensive packages upfront.

This creates an environment where:

The moat around established players narrows – When AI can bridge functionality gaps, being comprehensive becomes less of a competitive advantage

Evaluation criteria fundamentally shift – "How well does this integrate with our AI tools?" becomes as important as "What features does this include?"

The implementation and value timeline accelerates – Value realization no longer depends on months-long implementation projects

What This Means for Different Stakeholders

For B2B Software Providers

The implications are profound:

Sales motion transformation is essential – Moving from enterprise-wide deals to land-and-expand models that complement PLG requires rethinking sales compensation, territory design, and success metrics.

Product architecture shifts are inevitable – Breaking monolithic suites into composable, API-first components that can be adopted incrementally becomes crucial.

AI integration strategy must go beyond features – AI needs to be seen not just as a feature set but as an extensibility mechanism that allows your core product to be customized without heavy professional services.

Customer success becomes the growth engine – When adoption is bottom-up, expansion depends on demonstrating value to existing users who become internal champions.

For B2B Buyers and Technology Leaders

This evolution also changes how buyers should approach selection:

Empower users in the selection process – Rather than starting with RFPs, start with pilots and user feedback.

Evaluate extensibility, not just current capabilities – How easily can the solution grow and adapt through AI and integrations?

Consider time-to-value as a primary metric – How quickly can teams see tangible results without extensive implementation?

Look for evidence of active user communities – Strong PLG products typically have engaged user bases that share knowledge.

Real-World Evidence of the Shift

This isn't theoretical—we're seeing it play out across multiple sectors:

Observability tools like Datadog gained widespread adoption through developer usage before expanding to enterprise deals

Design tools like Figma spread through designer communities before becoming corporate standards

Development environments like GitHub became ubiquitous through individual developer choice

Even in traditionally top-down categories like ERP and CRM, we're seeing more modular approaches that allow for incremental adoption rather than all-or-nothing implementations.

The Path Forward: Bridging Two Worlds

The most successful B2B software companies won't completely abandon enterprise selling—they'll bridge these worlds by:

Creating smooth transitions from individual usage to team adoption to enterprise deployment

Building product experiences that delight users while providing the governance and security that enterprises require

Developing sales teams that can support both bottom-up adoption and executive-level value conversations

Using AI as a force multiplier rather than just another feature on a checklist

For buyers, this means developing a dual-track approach: supporting user-led adoption while ensuring enterprise requirements around security, compliance, and integration are addressed.

What's Next

This transformation is still in its early stages, but its trajectory is clear. In the coming posts in this series, I'll explore:

How microsegmentation is replacing broad industry classifications to align entire organizations around specific customer needs

Why AI is making feature wars less relevant and creating new evaluation criteria

How to integrate PLG, microsegmentation, and AI into a cohesive B2B growth strategy

The B2B software landscape is being rewritten before our eyes. Those who recognize and adapt to these shifts will find themselves with significant advantages—whether they're building, selling, or buying technology.

In the next post, I'll share how my experience at Chargebee demonstrated the power of moving beyond standard industry classifications to create targeted microsegments that aligned our entire organization around specific customer needs. Subscribe to ensure you don't miss it.

Beyond Industry Buckets: The Strategic Power of Microsegmentation in B2B

This is the second article in a four-part series examining how PLG, AI, and microsegmentation are transforming B2B technology marketing, sales, and product strategy.

What changes are you seeing in how B2B software is evaluated and purchased in your organization? Has bottom-up adoption changed your approach to selecting tools? Share your thoughts in the comments.

About the Author: Omar Nawaz is the founder of ilimcraft, an advisory firm helping B2B SaaS leaders scale smarter and grow faster. He writes the Growth Blueprint to explore strategy, product, and leadership in the AI era.